Sample Assay Results Confirm Mineralisation

Caracal Gold plc / EPIC: GCAT / Market: Main / Sector: Mining

13 December 2022

Caracal Gold plc ('Caracal' or the 'Company')

Results Confirm High-Grade Mineralisation on the Vim Rutha Prospect

a Parallel Structure to the Kilimapesa Hill Deposit

Caracal Gold plc, the expanding East African gold producer with over 1,300,000oz JORC-compliant gold resources, is pleased to announce sample assay results from its Diamond Drilling ('DD') programme on the Vim Rutha prospect, a shear zone of about 4.9km parallel to the known orebody at the Kilimapesa Hill deposit ('Kilimapesa Hill') at the Kilimapesa Gold and Mining Operations in Kenya (the 'Project'). The drilling intercepted, on several occasions and over a distance of more than 2km from west to east, one or more mineralised structures of significant thickness located a few hundred metres south of Kilimapesa Hill.

Highlights

· Assay results confirm the Vim Rutha prospect corridor is intensely gold-bearing, with mineralised intercepts returned from historical diamond drilling as well as the vertical and lateral extension of one or more parallel mineralised structures, over several kilometres of distance just south of Kilimapesa Hill.

· To date, 107 holes totalling 10,424m of the planned 12,000m Reverse Circulation ('RC') drilling programme and 21 holes totalling 3,637.7m of the planned 3,000m DD programme, which commenced in December 2021, have been completed.

· Results continue to demonstrate the high gold potential of the various exploration prospects located in direct proximity to the Kilimapesa Hill deposit or in the same geological environment.

· Results of 722 samples from Batch 5 have been received and results from the DD holes include:

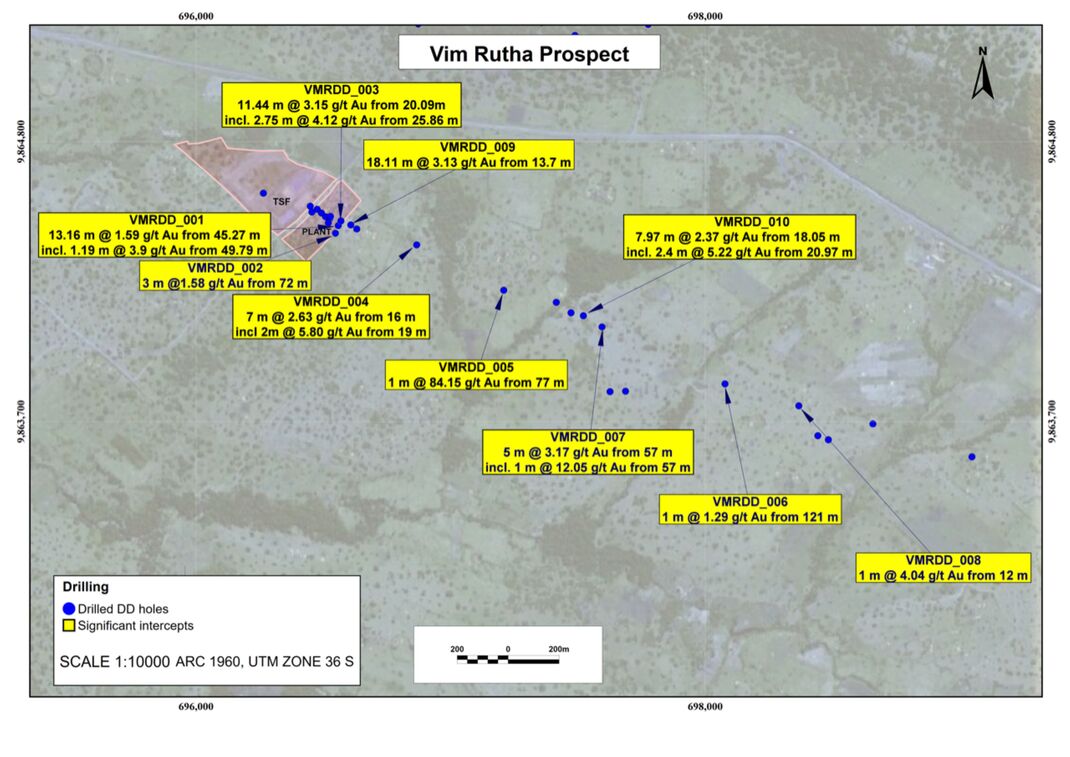

o Hole VMRDD_001 : 13.16 m @ 1.59 g/t gold ('Au) from 45.27 m incl. 1.19 m @ 3.9 g/t Au from 49.79 m

o Hole VMRDD_002: 3 m @ 1.58 g/t Au from 72 m

o Hole NMRDD_003 : 11.44 m @ 3.15 g/t Au from 20.09 m incl. 2.75 m @ 4.12 g/t Au from 25.86 m

o Hole VMRDD_004: 7 m @ 2.63 g/t Au from 16 m incl. 2 m @ 5.80 g/t Au from 19 m

o Hole VMRDD_005: 1 m @ 84.15 g/t Au from 77 m

o Hole VMRDD_006: 1 m @ 1.29 g/t Au from 121 m

o Hole VMRDD_007: 5 m @ 3.17 g/t Au from 57 incl. 12.05 g/t Au from 57 m

o Hole VMRDD_008: 1 m @ 4.04 g/t Au from 12 m

o Hole VMRDD_009 : 18.11 m @ 3.13 g/t Au from 13.7 m

o Hole VMRDD_010 : 7.97 m @ 2.37 g/t Au from 18.05 m incl. 2.4 m @ 5.22 g/t Au from 20.97 m

· In parallel to the DD programme, which took place on the Vim Rutha prospect, 21 RC holes and 2 trenches were completed along the same mineralised corridor.

o Initial geological observations are encouraging and 1,578 samples have been sent to SGS's laboratory in Tanzania (Mwanza) for gold analysis.

· The sixth batch of RC and trench samples have been delivered to the laboratory. These include samples from 21 RC holes and 2 trenches from the Vim Rutha prospect.

· The success of the exploration progam on Vim Rutha has meant that most of the activities will be focussed on confirming it's a discovery of economic significance and then moving quickly to an initial MRE. Activities across the balance of the exploration licence will continue these include, West Kilimapesa Hill, Teng-Teng, Maghor and Olepoipoi.

Chief Executive of Caracal Gold Plc, Robbie McCrae, said:

"We have always believed in the possibility we will discover large open-pittable style resources at Kilimaespa, as can be found across the border in Tanzania. It is very early stage at Vim Rutha but the thinking behind the exploration programme is to target a large open-pittable resource that could possibly support the development of a large Tanzanian/West African style gold mine. The 1m @ 84g/t Au in DD 005 is exciting as it is early confirmation that we have high grade potential at Vim Rutha, but I am most excited about the widths and grades in DD 003, 004, 007, 008, 009 and 010 and the fact that these results are consistent over 2km of strike. The results from the first few trenches and reverse circlulation holes will follow soon and exploration work is ongoing daily - we have a long way to go and a lot of work to do but early indications are that Vim Rutha could be a second economically viable deposit in our Kilimapesa licence; 2023 is shaping up to be a very exciting year for all our stakeholders."

Figure 1: Map to show the Drilled DD holes and significant intercepts across the Vim Rutha Prospect.

Figure 1: Map to show the Drilled DD holes and significant intercepts across the Vim Rutha Prospect.

Figure 2: Shows the ongoing progress of the trenching program across the Vim Rutha prospect

Figure 3: Drill core from Vim Rutha, showing sericite, chlorite, ankerite, pyrotite, pyrite, calcite association. All typical mineral association in Greestone Belt.

** ENDS **

For further information visit www.caracalgold.com or contact the following:

|

Caracal Gold plc Robbie McCrae Sheila Boit |

|

|

VSA Capital Ltd Financial Adviser and Joint Broker Andrew Raca (Corporate Finance) Andrew Monk (Corporate Broking) |

+44 203 005 5000 |

|

Clear Capital Markets Limited Joint Broker Keith Swann / Jon Critchley

|

+44 203 897 0981 / +44 203 869 6086 |

|

St Brides Partners Ltd Financial PR Oonagh Reidy / Charlotte Page / Isabelle Morris |

|

|

DGWA, the German Institute for Asset and Equity Allocation and Valuation European Investor and Corporate Relations Advisor Stefan Müller / Katharina Löckinger |

|

Notes

Caracal Gold plc is an emerging East African focused gold producer with a clear path to grow production and resources both organically and through strategic acquisitions. Its aim is to rapidly increase production to +50,000oz p.a. and build a JORC compliant resource base of +3Moz.

Caracal is executing its growth strategy beyond its 100% owned Kilimapesa Mine in Kenya by acquiring additional assets in Tanzania in order to grow group resources. Its experienced team, with proven track record in successfully developing and operating mining projects throughout Africa continues to review other complementary and strategically located projects in East Africa.

Caracal is a responsible mining and exploration company and supports the positive social and economic change that it contributes to the communities in the regions that it operates. It is a proudly East African-focused company: it buys locally, employs locally, and protects the environment and its employees and their families' health, safety, and wellbeing.

Caracal's shares are quoted on the Main Market of the London Stock Exchange (LON: GCAT) and on the Frankfurt Stock Exchange (FSE: 6IK); a listing on the Nairobi Securities Exchange is underway.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

Latest directors dealings

- 1 day ago The Renewables Infrastructure Group Limited

- 1 day ago The Renewables Infrastructure Group Limited

- 1 day ago Smurfit Westrock (DI)

- 1 day ago Menhaden Resource Efficiency

- 1 day ago BP