Lithium and Tantalum Infill Drill Programme Update

22 November 2022

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in the United Kingdom pursuant to the European Union (Withdrawal) Act 2018. Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

AfriTin Mining Limited

("AfriTin" or the "Company")

Lithium and Tantalum Infill Drill Programme Update

AfriTin Mining Limited (AIM: ATM), an African technology metals mining company with a portfolio of mining and exploration assets in Namibia, announces further results from the lithium and tantalum drilling programme at the Company's flagship operation, the Uis Mine ("Uis").

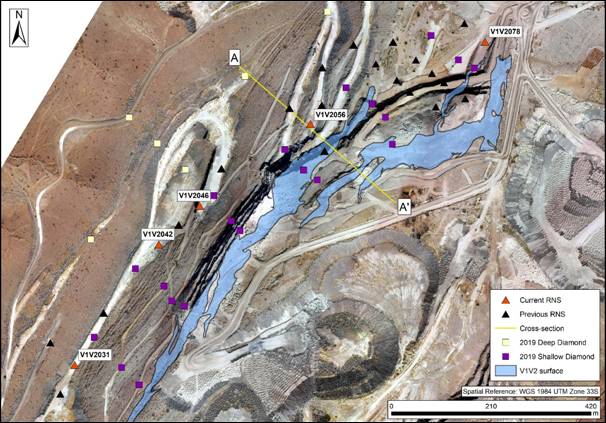

The 50-hole drilling programme, comprising 29 diamond and 21 reverse circulation (RC) drill holes, aims to increase the confidence of the existing lithium and tantalum mineral resource estimates over the deposit. A total of 49 drill holes have been completed and are being processed. The results of 20 previous holes were announced on 8 June 2022, 20 July 2022 and 10 October 2022. This announcement reports the assay results of the next 5 drill holes (Figure 1). The results of the outstanding 24 drill holes will be provided once received.

Highlights:

· Pegmatite was intersected in all holes at depths and apparent widths predicted by the geological model;

· Significant pegmatite intersections include:

o 114 m at 0.151% Sn, 75 ppm Ta, and 0.63% Li2O within drill hole V1V2042, from 116 m to 230 m;

o 108 m at 0.146% Sn, 65 ppm Ta and 0.65% Li2O for hole V1V2046, from 101 m to 209 m;

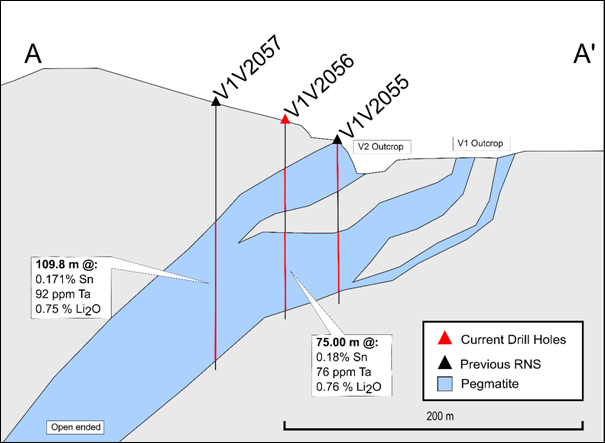

o 75 m at 0.183% Sn, 76 ppm Ta, and 0.76% Li2O from 92 m to 167 m; and

o 23 m at 0.153% Sn, 102 ppm Ta and 0.46% Li2O from 57 m to 80 m for drill hole V1V2056.

· Notable intersections of lithium mineralisation within the pegmatite intersections include:

o 10 m at 1.35% Li2O for drill hole V1V2042 from 211 m to 221 m; and

o 38 m at 1.00% Li2O for drill hole V1V2056 from 107 m to 145 m.

Anthony Viljoen (CEO) commented:

"We are pleased to announce these exploration drill results which are once again in line with our high expectations for the V1/V2 pegmatite ore body. The drill holes reported in this announcement are distributed over the entire strike of the pegmatite and are indicative of the consistency of the lithium, tin and tantalum mineralisation. We are particularly encouraged by the lithium grades intersected in drill holes V1V2042 and V1V2056, which further demonstrate the unrealised potential of the Uis orebody. As we near the end of this exploration programme, we look forward to upgrading the mineral resource estimate in support of our by-product development projects for tantalum and lithium."

Exploration Programme

The current exploration programme aims to upgrade the existing resource classification for lithium and tantalum over the areas where tin is currently classified within the measured and indicated categories for the 2019 JORC (2012) compliant mineral resource estimate (MRE) (see announcement dated 16 September 2019). The pegmatite intersections of the reported holes align with the current geological model, confirming its spatial accuracy. The drill holes intersected the pegmatite at shallow depths where the V1 and V2 bodies have bifurcated into individual units, as well as greater depths where the units coalesce to form a single unit. The dip angle of the pegmatites varies from 24 degrees to 48 degrees and the reported drill holes are orientated vertically such that reported intersections represent apparent thickness.

Table 1 : Exploration results of RC drill holes V1V2031, V1V2042, V1V2046, V1V2056, and V1V2078 indicating the full pegmatite intersection and pegmatite grades. Intersections are indicative of apparent thickness and not true thickness; note that apparent thickness is greater than true thickness .

|

Hole ID |

Dip Angle (Degrees) |

Pegmatite |

|

From/To (m) Including Waste |

Interval (m) |

Grade |

||

|

Sn (%) |

Ta (ppm) |

Li2O (%) |

||||||

|

V1V2031 |

Vertical |

V2 |

Whole Intersection |

162 - 194 |

32 |

0.146 |

83 |

0.61 |

|

V1V2042 |

Vertical |

V1/V2 |

Whole Intersection |

116 - 230 |

114 |

0.151 |

75 |

0.63 |

|

Including |

211 - 221 |

10 |

0.152 |

39 |

1.35 |

|||

|

V1V2046 |

Vertical |

V1/V2 |

Whole Intersection |

101 - 209 |

108 |

0.146 |

65 |

0.65 |

|

V1V2056 |

Vertical |

V2 |

Whole Intersection |

57 - 80 |

23 |

0.153 |

102 |

0.46 |

|

V1 |

Whole Intersection |

92 - 167 |

75 |

0.183 |

76 |

0.76 |

||

|

Including |

107 - 145 |

38 |

0.186 |

82 |

1.00 |

|||

|

V1V2078 |

Vertical |

V1 |

Whole Intersection |

37 - 47 |

10 |

0.089 |

181 |

0.36 |

The drilling method for the holes in Table 1 is reverse circulation (RC). Each drill hole was geologically logged before being sampled at one-meter intervals. Sample analysis was undertaken by UIS Analytical Services, a certified independent laboratory, using a peroxide fusion; ICP-OES analysis was utilised for major and minor elements and ICP-MS was utilised for the trace elements.

Figure 1: Map displaying the localities of the reported holes, the drill holes of the previous (2019) exploration programme and the holes from the current programme previously reported. Line A-A' indicates the area represented by the cross section (Fig.2).

Figure 2: Section line A-A' displaying a projection of the holes drilled during the current programme for which the results are reported in this release and previous communications for this programme.

Competent Person Statement

The technical data in this announcement has been reviewed by Michael Cronwright (M.Sc., FGSSA, Pr. Sci Nat. (Geological Sciences)). He is a full-time employee of CSA Global, and provides geological consulting services to AfriTin. Mr Cronwright is the Principal Consultant - Battery Metals co-ordinator for CSA Global and has 22 years of industry related exploration as well as mineral project development experience and is a Competent Person for the reporting of these exploration results. He has reviewed both the technical disclosures in this release as well as the quality assurance protocols and results for the assay campaign. Mr Cronwright consents to the release of the information contained in the announcement and is satisfied that the results of the QAQC on the assay results released to date are sufficient to support the planned estimation of mineral resources.

Glossary of abbreviations

|

ICP-MS |

Inductively Coupled Plasma-Mass Spectrometry |

|

ICP-OES |

Inductively Coupled Plasma-Optical Emission Spectrometry |

|

Li |

Symbol for Lithium |

|

Li → Li 2 O |

Metal to metal-oxide conversion factor of 2.153 |

|

Li 2 O |

Lithium oxide |

|

JORC |

The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves |

|

MRE |

Mineral Resource Estimate |

|

PPM |

Parts Per Million |

|

QA/QC |

Quality Assurance / Quality Control |

|

RC |

Reverse Circulation drilling |

|

Sn |

Symbol for Tin |

|

Ta |

Symbol for Tantalum |

|

V1/V2 |

Name of the targeted pegmatite unit, V1/V2 denotes where the V1 and V2 pegmatites have merged at depth. |

Glossary of Technical Terms

|

Apparent Thickness |

The relationship between apparent width and true thickness is based on the formula by Addie (1968 Economic Geology, vol 63, pp 188-189). |

|

Dip Angle |

The angle of inclination measured downward from horizontal. |

|

Geological Model |

The interpretation of mineralisation and geology that controls mineralisation. This is usually generated in a three-dimensional computer environment. |

|

Mineral Resources |

Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. |

|

Pegmatite |

An igneous rock typically of granitic composition, which is distinguished from other igneous rocks by the extremely coarse and systematically variable size of its crystals, or by an abundance of crystals with skeletal, graphic, or other strongly directional growth habits, or by a prominent spatial zonation of mineral assemblages, including monomineralic zones. |

|

Xenolith |

A foreign rock fragment (e.g. schist) within an intrusive body (e.g. pegmatite) that is unrelated to the igneous body. |

|

AfriTin Mining Limited |

+27 (11) 268 6555 |

|

Anthony Viljoen, CEO |

|

|

Nominated Adviser |

+44 (0) 207 220 1666 |

|

WH Ireland Limited Katy Mitchell |

|

|

Corporate Advisor and Joint Broker |

|

|

H&P Advisory Limited Andrew Chubb Jay Ashfield Nilesh Patel |

+44 (0) 20 7907 8500 |

|

Stifel Nicolaus Europe Limited Ashton Clanfield Callum Stewart |

+44 (0) 20 7710 7600 |

|

Tavistock Financial PR (United Kingdom) |

+44 (0) 207 920 3150 |

|

Emily Moss Catherine Drummond Adam Baynes |

|

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed technology metals mining company with a vision to create a portfolio of globally significant, conflict-free, producing and exploration assets. The Company's flagship asset is the Uis Tin Mine in Namibia, formerly the world's largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and management team with a current strategy to ramp-up production at the Uis Mine in Namibia to more than 10,000 tonnes of tin concentrate and 350,000 tonnes of lithium concentrate in a Phase 2 expansion, having reached Phase 1 commercial production in 2020. The Company strives to capitalise on the solid supply/demand fundamentals of tin and lithium by developing a critical mass of resource inventory, achieving production in the near term and further scaling production by consolidating assets in Africa.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

Latest directors dealings

- 24 minutes ago Morgan Sindall Group

- 24 minutes ago Spirax Group plc

- 29 minutes ago Morgan Sindall Group

- 53 minutes ago SSE

- 59 minutes ago B&M European Value Retail S.A. (DI)